Helping Win the “Battle” by Applying Advanced Information Technology Architectures, Technologies, & Processes

Thomas Fountain

VP & CIO

Engines, Systems, & Services

Abstract

This paper provides the structured decomposition of a proposed, information-based, strategic weapon. “Smart Operations,” is envisioned to drive significantly smarter and faster decision-making in all facets of the enterprise. That improvement presents an opportunity to create tangible Customer Value through both direct and indirect channels across the information value chain.

Key components, working examples, and required organizational competencies of “Smart Operations” are provided. In addition, supporting IT Strategy, Architecture, and Technologies are offered to promote thought and discussion of development and implementation strategies that will provide the technical underpinnings required to support “Smart.”

A. Strategic Hypothesis

It is assumed that businesses will continue their march toward higher degrees of virtualization (e.g. outsourcing non-core operations), globalization, and use of dynamic execution models. In these scenarios, conventional command and control methods will prove limited in their ability to handle this highly dynamic and complex situation because of their primary dependence on human decision-making. With proper strategic development of systems, modeling, and advanced analytic capabilities the fullest manifestation of the opportunity virtualization presents can be realized. This advanced state is characterized by an optimal, dynamic, real-time, configure-on-the-fly business model that leverages internal and external capabilities with staggering precision. Such a construct would sense, decide, and take action instantly, leveraging the absolute best information and capabilities at its disposal at a given time. Such a business would be highly competitive, hard to replicate, and consistently “one step ahead.”

B. Business Objectives and Customer Value

B.1 The Outside-In Imperative

It is always worthwhile to remind ourselves that Value is truly in the eyes of the Customer. Internal or external, Customers define the worth of what Suppliers produce. Customers simply must believe that your Products, Services, or Intangible benefits are real and convertible into improved value proposition to their Customers. Fortunately it is typically inspiring and productive to truly examine the problems faced by customers rather than working within the perceived bounds erected by presuming expected solutions.

B.2 Value Creation

There are many ways to create value for Customers. As noted above, value is typically associated with providing “inputs” to your Customers that improve their ability to create value for their Customers. The following four questions may prove beneficial as one investigates the opportunities to create value for Customers.

- Do my inputs make my Customers operations / products better?

- Can I substitute my work in place of my Customers’ at equal / better performance?

- Can I make my operations better and share those gains with my Customer?

- Can I create truly new products / services and (positively) redefine the Customer’s Value Chain?

These and other questions force a Supplier to understand who the Customer is, what is critical to the success of that Customer, and what approach may be most valuable in the eyes of the Customer.

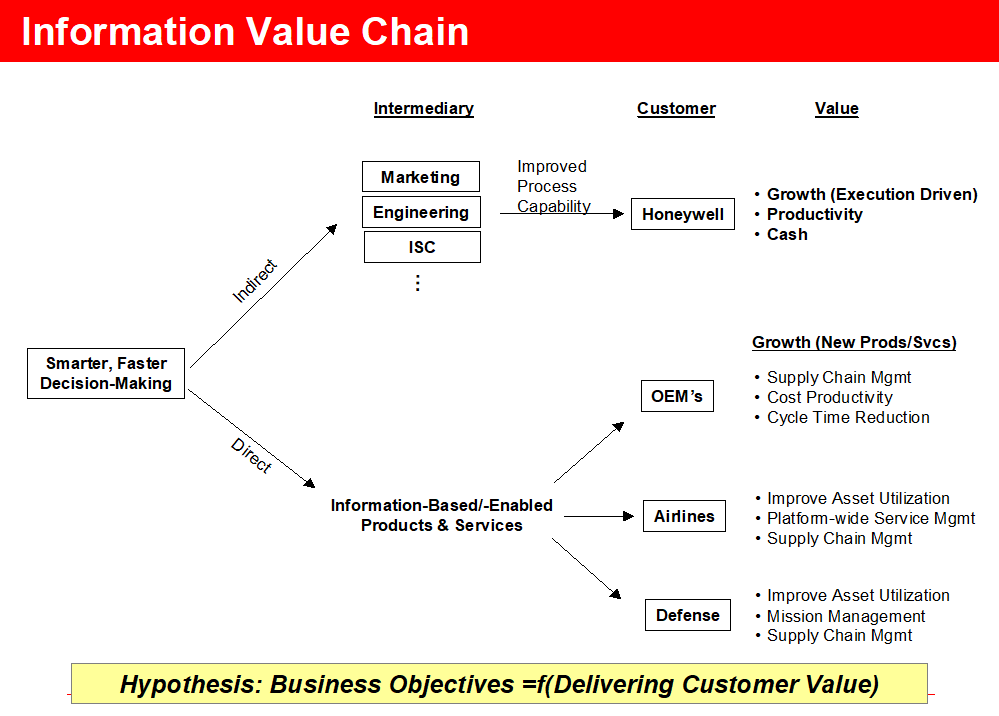

B.3 Information Value Chain

It is assumed that creating and delivering Customer value is directly correlated to achieving Business Objectives. As we investigate various types of value creation opportunities it is helpful to place those in a “channel” framework. Within this framework we can highlight core capabilities (e.g. “Smart Operations”) that may have both direct and indirect paths to reach and solve business problems for which we can calculate an ROI. Figure B.3 broadly highlights both an indirect and direct channel framework with example forms of “value.”

Internally, the improved speed and quality of decision-making can be applied in the context of typical functional / customer-serving processes. The resulting improvement in process capability, whether reducing inventory, shortening Service delivery cycle times, or finding a lower cost Supplier, empowers the business to better execute against it’s objectives. Presuming the business can in turn translate those process improvements into Business results, the standard measures of Growth, Operating Income, and Cash Flow can be applied.

Externally, the leveraged use of information can create a truly new class of information-enabled or even information–based products or services. These new solutions would directly offer value to customers – helping them solve operational or business problems in fundamentally new ways. Such value is typically measured directly in terms of Product Revenue and Margin and fortunately readily available feedback ensures shortened decision-making time as to whether Customers value such an offering.

B.4 Process Improvement and Customer Value

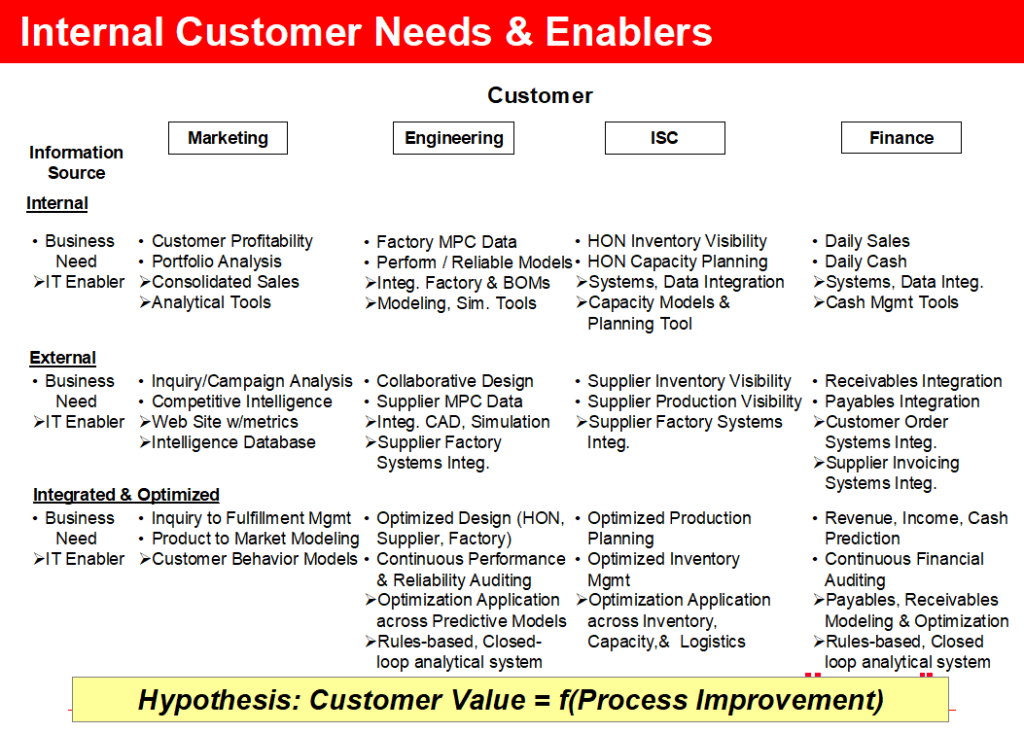

In terms of creating Customer Value it is imperative that a Supplier understand Customer Needs. Once these needs are known a variety of techniques can be utilized to understand the key processes involved. With a process understanding key inputs and transformations can be examined to drive improvement and ultimately competitive position. Figure B.4.1 represents a potential set of Process Improvement needs for a set of internal Customers. Note that for internal Customers these process improvements are generally internally focused, and that the business must be capable of translating these internal improvements to end Customer value.

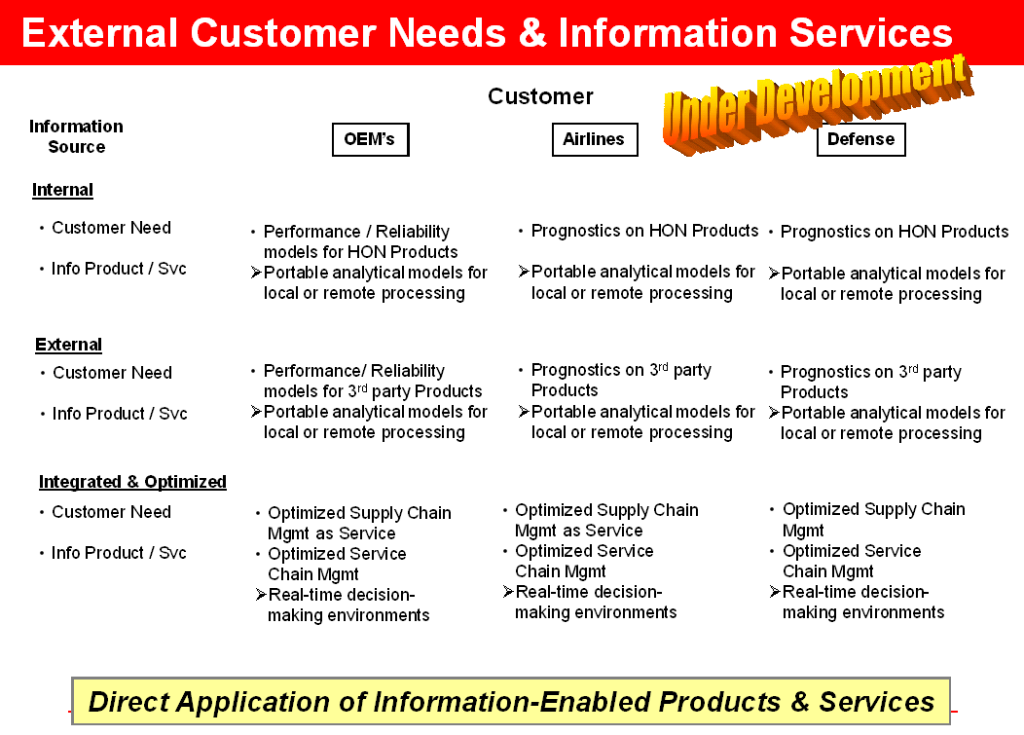

For External Customers, Value creation is specifically tied to products and services that directly impact the Customer’s value chain. In our discussion these are focused on potential information-based or information-enabled offerings. Figure B.4.2 represents a sampling of external Customer needs and the associated Information-based enablers.

Of note, the alignment of information sources along the internal, external, and integrated dimensions provides entry into an analysis of potential execution strategy. Typically internal information sources are the most readily available and controllable. Second, external sourcing of key operational, business, etc information can be similarly high value but a degree more difficult to access and maintain reliably. Finally, the integration and optimization of both sources of data obviously depends on availability and the analytical capability to perform the advanced integration, decision-making, and use of optimized results.

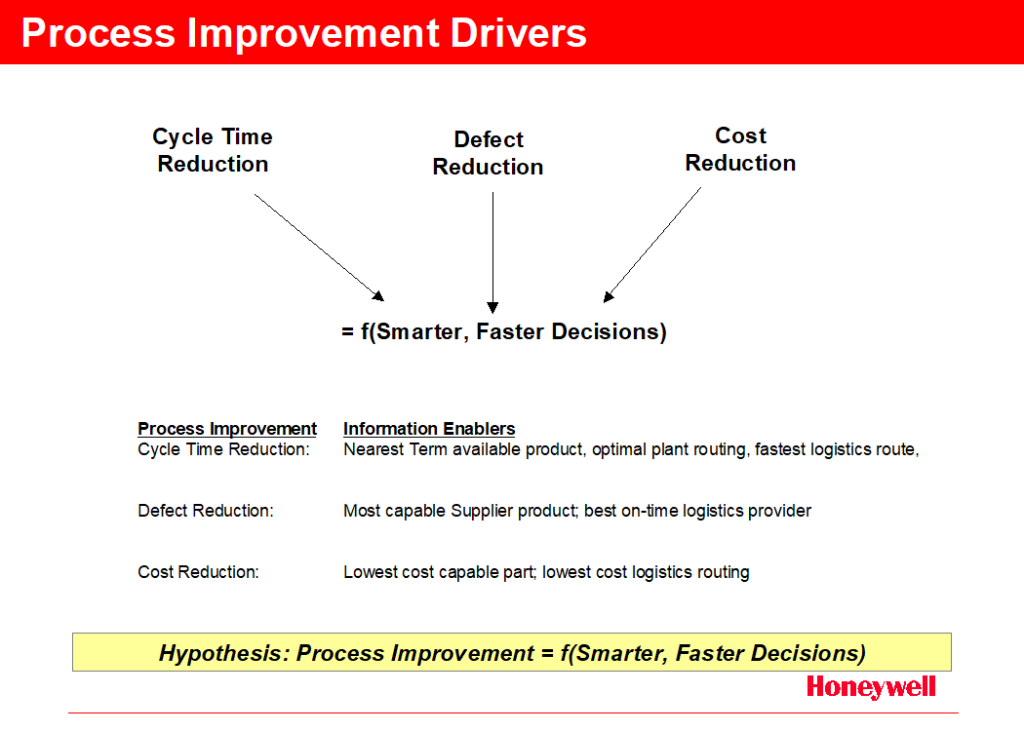

B.5 Process Improvement Drivers

Taking the next step it is necessary to understand opportunities for process improvement and potential drivers. Again we are focused on the speed and quality of decision-making and how it drives cycle time, defect, and cost reductions. Figure B.5 offers a sampling of opportunistic approaches to improving key business processes. Each is dependent on availability of information or knowledge that has a direct impact on decision-making quality.

C. “Smart Operations”

C.1 Hypothesis

The hypothesis of “Smart Operations” is that ever smarter, ever faster decision making by an organization yields sustainable competitive advantage. To a large degree everything a business does involves decisions: what to sell, where and with whom to conduct business, where and how to ship material, etc. Imagine always knowing the best course of action in any business scenario because all available data, information, and knowledge has been integrated into the decision-making process. Note that not only are all information assets are consulted, but a decision-making rule, optimized over hundreds or thousands of prior occurrences, has been built and executes in near real-time.

In addition, as the networked economy continues to grow and businesses continue to outsource (virtualize), an ever growing, ever richer set of information becomes available. Businesses with a strategy to proactively partner on a basis of execution skills and “available smarts” will reap higher than normal benefits as they harvest the extension of their intelligence capability.

C.2 Framework

“Smart Operations” is all about a radical cycle time reduction and quality improvement in the “sense – analyze & decide – act” control loop. Conventional businesses processes typically are not built with such an alignment in mind. Why?

- Often we do not know what data to collect because we do not know what data (and in turn information and knowledge) will empower our action

- We have not built analytical capabilities to synthesize the wide range of information available to produce smarter decisions

- Decision-making is often in the heads of a distributed number of people and is inconsistently applied across the range of encountered situations

- We have not built an ability to activate our decisions, instead we rely on people and manual means to take action (e.g. sending a faxed purchase order when we need more material)

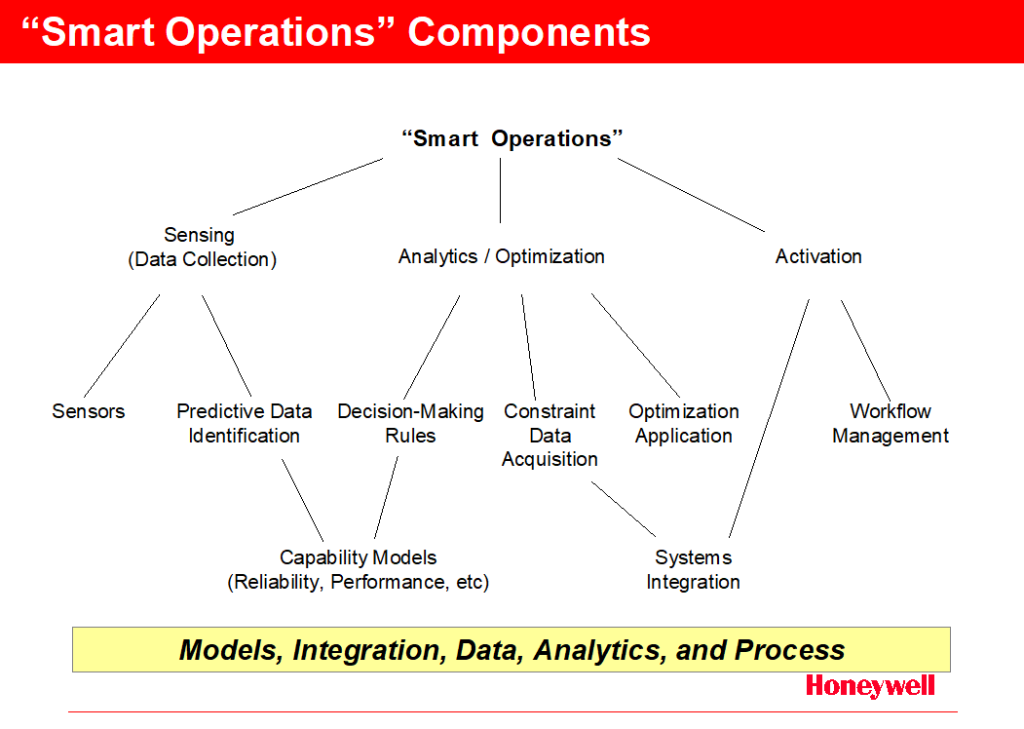

To construct a “Smart Operation” we must actively seek to understand the necessary building blocks of “Smart” then develop an execution plan to construct it. Figure C.2 lays out the constituent building blocks and decomposes them into critical components of a comprehensive solution.

C.3 Sensing

Sensing has several critical components. Naturally, the ability to physically acquire data of interest is fundamental. Fortunately in the digital world that problem is typically easy. The growing number of cheap, advanced analog sensors is also greatly simplifying the problem. The other critical component to sensing is knowing what not to collect. It is important that one know which variables actually have the ability to improve decision-making speed and quality. All other variables should be avoided as they will only slow down and potentially detract from overall results.

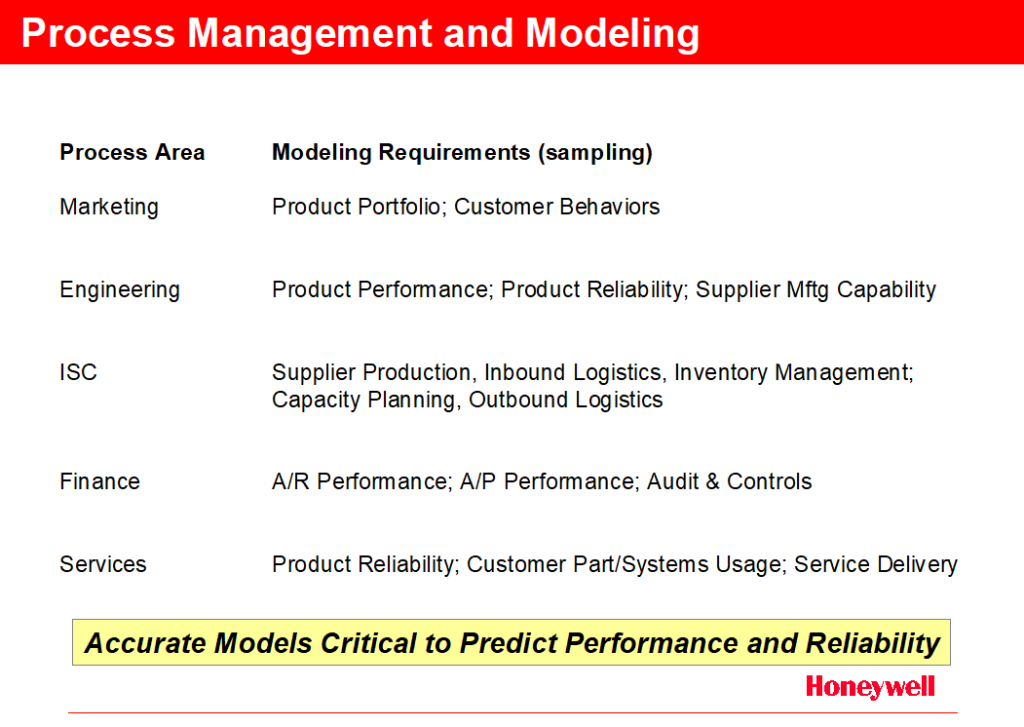

To determine what variables are value-added a variety of techniques are available, not the least of which is Six Sigma. Six Sigma provides for the structured decomposition of objectives and the understanding of input variables and integrating transfer function. In addition to classic Six Sigma there are a number of modeling tools like neural networks that can discover higher order effects between several variables. Such advanced tools can rapidly assist the modeler in understanding and even predicting behavior. Figure C.3 lists several obvious modeling inputs required to drive both Sensing and Analytical processing (see below). In short any model addressing Customer, Suppliers, Product, or Process capabilities is a likely candidate to enrich the overall “Smart Operations” environment.

C.4 Analytics & Optimized Decision-Making

Large-scale, high performance analytical capabilities are required to process the potentially large, high bandwidth data streams present in complex systems. Again Six Sigma is a foundation for developing the transfer functions that transform given inputs into an optimal output. Analytics can be either centralized or distributed, depending on the design challenges of a given situation.

This component must also handle both single, point-in-time situations, and long running scenarios where multiple decisions are made over a period of time. Thus the analytics must maintain a running state of computations and respond to multiple, refreshed inputs in near real-time. Significant opportunity for optimization is also present, given our ability to gather constraint data, understand relationships between inputs, and model Customer reaction.

C.5 Activation

To complete the control loop, we must have the ability to activate our optimized response in near real-time. To do this, the controls over key business processes must be instrumented and remotely controllable. As the decision-making layer completes its processing, control signals are sent internally and externally to execution elements. This is yet another key component where it is necessary to integrate all aspect of “Smart” to realize the full realizable benefits.

In long-running scenarios there will likely be many cases where there is a need to re-optimize around a changed input variable. The analytic and decision-making layer must re-optimize as necessary, in concert with the sensing layer collecting the changed constraint variable and determining if it is necessary to pass to the analytical layer.

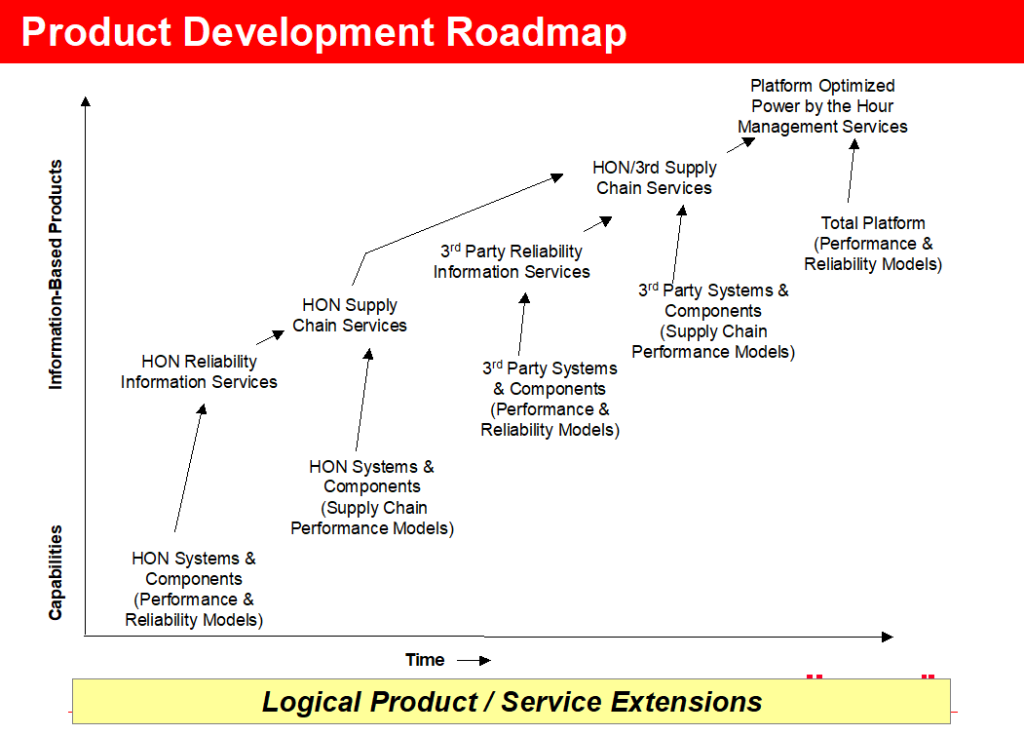

C.6 Product Development

Figure C.6 depicts a potential product development roadmap that capitalizes on the step-by-step approach logically pursued within “Smart Operations.” As performance and capability models are developed they can drive both internal process improvements and directly offered to external Customers as value-added services. This example is focused on Product Reliability Information Services and Supply Chain Management Services but examples of similar applications in other areas are easily constructed.

C.7 Applications

While Applications will be explored in detail below, it is worthwhile to list some of the specific business scenarios where “Smart Operations” can be applied. This list is simply representative and is meant to provide connectivity to real-life business problems.

- Predictive Trend Monitoring with Optimized Service Response Planning, & Execution

- OEM Product Recall

- Battlefield / Mission Management

D. IT Strategy

D.1 Vision

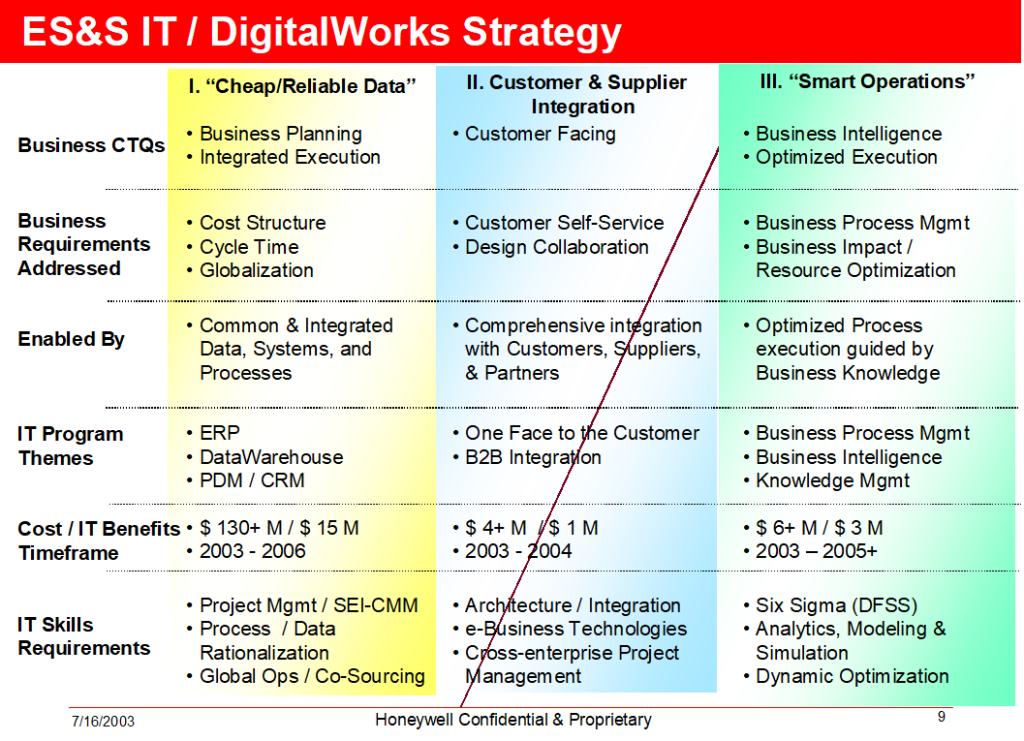

Seizing upon the opportunities offered by “Smart Operations” ES&S IT has crafted a vision aligned with the objective of supporting the business in every business activity. “Optimal Decisions @ the Speed of Light” refers to the ever smarter, ever faster philosophy.

D.2 Strategic Overview

ES&S IT has developed 3-phase IT Strategy (Figure D.2) that is responsive to both the current state of systems and the strategic requirements to enable “Smart Operations.” It is ES&S IT’s intent to significantly re-shape the competitive “mountain” to favor ES&S’ fast recovery of competitive position. Re-shaping that “mountain” requires vision and active influencing of future needs on current state designs.

D.3 External Factors

Numerous external factors support this strategic view. Chief among them are the following:

- Globalization and the restructuring of Operations to realize cost competitiveness

- Integration among Customers, Supplier, and Partners in the search for efficiencies

- Speed and the emphasis on reduced cycle time

Each of these phenomena drives business toward concepts like “Smart.” “Smart” represents a method to directly deal with the spiraling complexity of managing a large and fast growing network of “partners” all involved in ever more granular pieces of the value chain. The ability to dissect and re-build a Company’s value chain without the typical time, quality, and integration cost penalties offers Business Strategists and Process Designers unparalleled opportunity.

D.4 Phase I. “Cheap, Reliable Data”

“Cheap, Reliable Data” conveys the need for ES&S to dramatically simplify, rationalize and consolidate existing processes, data, and systems. ES&S today has over 1,300 software applications providing basic and advanced transactional and analytical capabilities. This tremendous diversity of systems drives excessive Operations costs, severely limits the business’ ability to respond quickly, compile meaningful analyses, and provide the level of integrated Customer Servicing required today.

Phase I will focus on implementation of the Aerospace Transactional Backbone (SAP as an ERP choice) and supporting Information Warehousing capabilities. This multi-year effort will exceed 3 years and $ 100 M. In return, the rationalization and simplification of internal processes will allow massive improvement in cycle times, defect reduction, and cost of Service. Importantly, Phase I will enable both follow-on phases of the IT Strategy, as today customer integration is impractical given the dozens of overlapping systems, and “Smart Operations” is unrealizable given the lack of a consistent Enterprise Data Model. Note that existing IT skills can be largely re-used on Phase I projects provided the additional globalization, collaboration, and cycle time requirements are properly incorporated.

D.5 Phase II. “Customer / Supplier Integration”

Phase II provides the connectivity to Customers and Suppliers that naturally make-up the business environment around ES&S. It is imperative that ES&S build cheap, reliable, and near real-time system-to-system linkages to provide mutual visibility to mission critical information. This integration will not only reduce tactical costs of doing business but provide an added layer of “stickiness” with Customers. The typical technologies in this phase are both Business-to-Business integration (B2Bi) platforms, XML, Web Services, etc. and classic Web-based presentation and human interaction portals. Timing is relatively short to built the foundation while it takes 12 to 18 months to build a high degree of maturity and speed in establishing these inter-company linkages. Here new IT skills are required, centered on e-Business enabling technologies, project managing inter-company projects, and participating in the design and implementation of various industry standards.

D.6 Phase III. “Smart Operations”

Phase III is essentially the heart of this paper, but in provides the capability to create, manage, and deploy knowledge and improved decision-making capabilities. It is imperative that the resulting Architecture and Technologies can be easily configured to solve real business problems. The elements of “Smart” are fortunately very incremental in nature thus avoiding large up-front expenditures to provide proof of concept. This phase requires an entirely new set of IT competencies. It will be essential for a measurable population of IT professionals have deep analytical, business process, knowledge management, and optimization skills. It is expected that by this time there will be significant import and export of talent between the various business functions and IT given the focus on business process and value creating decision-making.

D.7 Sequencing and Dependencies

As noted above Phase I is a foundational step. While there will not be a strict I, II, III on a total ES&S basis, sufficient progress must be made on systems rationalization must be made before integration efforts can be deployed. Certainly early research and design work will begin immediately. Similarly, “Smart Operations” requires consolidation and standardization of data. Again, early research and design can and will be done to reduce overall cycle time, particularly as the Aerospace ERP program will be focusing on major parts of the Enterprise Data Model.

E. IT Architecture

E.1 Need for a Holistic Approach

The required IT Architecture must support four key pillars of “Smart Operations”:

- the discovery, creation, management, and use of knowledge

- the creation of a rules-based execution environment to apply knowledge at the point of “attack”;

- the advanced analytics required to gain an increasingly sophisticated understanding of operational process capabilities, constraints, and opportunities

- the development of robust optimization and workflow management essential to solving large, complex, multi-dimensional business problems. This assumes that the prior Phases of the IT Strategy are already complete.

With this broad set of needs, the responsive architecture must have a highly integrated set of functional modules that individually create positive ROI. With a holistic approach it will maximize our chances of physical constructing a set of technologies and systems that most efficiently realizes our logical design.

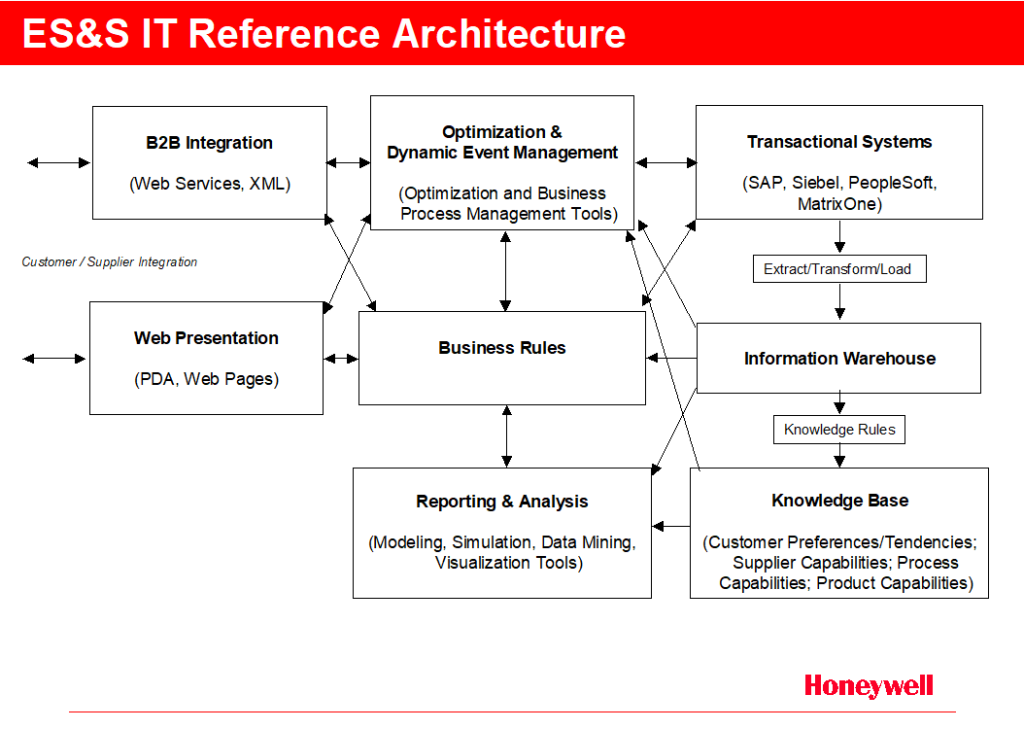

E.2 Reference Architecture Overview & Block Diagram

The reference architecture consists of 8 functional blocks, each of which requires its own set of technologies, underlying foundational services, and highly efficient and robust integration capabilities. Note this is a logical architecture. Actual physical implementation of these concepts may yield a very different physical plan.

E.3 Transactional Systems

One of the most significant strategic opportunities in ES&S IT is the transactional systems space. Today over 1,300 applications are in use and significant redundancy exists across many functions and processes. ES&S (as part of a larger Aerospace Backbone program) has launched a 3 year $ 130 M program to implement SAP. This program will realize significant process, data, and systems rationalization and provide a solid, flexible, and feature rich application. In addition, significant progress must be made in terms of the application architecture to successfully integrate the remaining best of breed applications (Matrix One; PeopleSoft, Siebel, etc) to form a comprehensive transactional management capability. A key enabler to successfully completing and maintaining integration between these disparate systems will be the introduction of a contemporary Enterprise Application Integration (EAI) tool. EAI provides a cost effective means to integrate multiple applications with one interface per application. EAI facilitates tremendous flexibility for future application activities as complex interfaces are avoided.

For the future, flexibility and scalability will be critical as well as the ability to extend globally while maintaining a predominance of centralization.

Fortunately many of the key skills required are common within ES&S today. Large program management; process re-engineering; and systems consolidation are core skills acquired through DigitalWorks and other initiatives.

E.4 Information Warehousing

Today, Information Warehousing is an incomplete collection of large and small data marts and a central Sales Warehouse. While individually successful, ES&S has not realized broad benefits as lack of broad information availability and inconsistent or under-developed tools have made it hit-or-miss for users.

Presently, an Aerospace-wide initiative will be addressing fundamental requirements for a successful warehousing environment. First up is the core data management tool. Second, the selection of an Extract-Transform-Load (ETL) solution will provide robust data extraction and cleansing, guaranteeing quality base data for analysis.

Going forward, the keys to success for information warehousing include solid scalability and excellent query performance across potentially large data sets. It will be critical for designers to have the vision of the end state desired, to ensure the warehouse has an original design that is both extensible and scalable. Smooth performance and storage scalability will also be critical to allow rapid growth without paying non-linear fees, even in the face of a business acquisition or other large data increase.

Here, some but certainly not all IT skills are in place. Aerospace Warehousing is currently evaluating organization design options and the requisite talent requirements.

E.5 B2B Integration

B2B integration is the cornerstone of the Phase 2 effort to provide robust and secure Customer and Supplier Integration for Honeywell. As described in the strategy section it is imperative to complement cheap, reliable internal data with readily available, near-real time, cheap external data. This is accomplished when Honeywell systems are directly connected to systems of Suppliers, Customers, Service Providers, etc. This importance will continue to rise as Honeywell continues to expand its Customer and Supplier base and more mission critical functions and processes are outsourced.

The B2B tool must solve the challenge of providing an XML handling foundation, including Web Services, while also meeting existing and near-term EDI requirements. With the emergence of competing XML schemas and eMarketplaces, Honeywell requires a flexible tool that comes with a solid number of existing connectors and protocol mappings. Also highly desirable is the ability to instrument information flows to provide rapid assessment of poorly performing or broken inter-enterprise connections

B2B integration, while not particularly difficult technically, does require an extended set of project management skills – particularly inter-enterprise situations.

In an ideal situation the B2Bi tool would also solve the EAI and Business Process Management requirements (see BPM below). Such a tool selection would solve 3 architecture requirements and avoid complex tool integration, thus simplifying ongoing maintenance.

E.6 Web-Based Presentation / Portal

Today ES&S’ e-Business capabilities are limited in scope and functionality. To date, a set of functionality is maintained in eSource, however eSource lacks extensive real-time connectivity to significant numbers of transactional and reporting systems.

Going forward, the Presentation / Portal will become the source for (human) Customer interaction with the Architecture. For external customers, this presents an opportunity to self-service their requests, utilizing a customized presentation for high productivity.

It is also key that the Portal interacts with users in multiple languages and multiple mediums. Web browsers (whether PC or PDA), various wireless devices and future forms of personal connectivity must also be supported. This is particularly important for Human-in-The-Loop processes where timely, informed decisions and inputs are critical to business success. In these cases it is imperative that key users are not disconnected from their supporting systems, assuring they continue to make the most informed, rapid decisions.

E.7 Knowledge Rules and Knowledge Base

The knowledge base provides the starting point for “Smart Operations.” The knowledge base holds knowledge “elements” that are key inputs to smarter decisions. These knowledge elements typically include (but are not limited to) Customer Preferences & Tendencies; Supplier Capabilities; Product Capabilities; and Process Capabilities. These elements can then be used in the decision-making process for virtually all areas of the business. Conveniently, these elements will often be outputs of the application of Six Sigma to the studied process. One could view the knowledge base as the repository of Vital “X’s”.

Knowledge rules are used to generate knowledge elements from the information warehouse layer. Knowledge Rules are implemented within the same ETL technology discussed earlier, but now we are extracting from the information warhouse. The key difference is a “smarter” (T)ransform, which extracts capability information, often based on modeling of the process, product, etc.

E.8 Business Rules Execution Environment

Business Rules are a convenient way to deploy the relevant decision-making expertise to the point where it can be used most productively. These rules represent the functions, typically f( ), that contain the logic describing how to combine vital inputs to determine the expected output. In this architecture, the key is to put these decision-making or decision-aiding rules “on the front lines” closest to the individuals or process elements that need to make smarter decisions. This is an added feature versus typical knowledge management, where key intelligence is kept in a database and interested or needy individuals must actively seek it out. Instead, the Business Rules proactively respond to events or requests by gathering all relevant inputs then making a decision / recommendation automatically.

Technically, Business Rules could be as simple as one or more Java components resident on an Application Server. Rules could further be interconnected to create complex, hierarchical logic if necessary to model complex decision-making activities. Note that rules could be built inside the relevant transactional system, but it is preferable to expose the rule logic such that other elements of the architecture can easily access it.

E.9 Reporting & Analysis

Reporting and Analysis provides two key functions. First, Reporting includes classic Ad hoc queries and pre-written reports. This standard methodology provides the bulk of reporting and often summarizes financial, supply chain, sales, etc information. Typically this reporting comes off the information warehouse but can easily be applied to transactional systems and the knowledge base. Secondly, advanced reporting can respond to user defined thresholds and actively generate a pre-written report and deliver in the users medium of choice. These thresholds can be thought of as alerts or alarms, specifically monitoring any pre-established key process variable. As the variable falls outside specific control limits, various reports can be automatically created, formatted, and delivered on any number of devices. Often, users implement pre-set indicator levels that respond with an e-mailed spreadsheet for a “Yellow” condition and a short text message to a phone or pager for a “Red” condition. This significantly helps an organization manage by exception, letting the systems do the monitoring work.

Analytical capabilities have recently advanced to include a wide variety of techniques including, process capability, data mining, visualization, modeling, and simulation. The tools, when properly applied, can yield a wealth of information and knowledge about a given process and lead the analyst to an improved understanding of how to control and even optimize an output.

These analytical tools form the foundation of an organization’s ability to “learn” based upon actual experience. Having applied the learning set of tools, an analyst can then apply modeling and simulation to better understand and predict the process results based upon potential rules changes. For example, altering a dispatch rule for technicians may have profound impact on Customer repair cycle time. To the extent possible, an analyst cold model and simulate the potential rule change impact before experimenting with actual customers. Simulation can also be used as an effective, although less efficient, method to develop optimized operations. A skilled analyst who has deep understanding of the involved processes may be able to use simulation to rapidly find process improving rules changes.

E.10 Optimization & Dynamic Event Management

The final required capabilities are those necessary top handle “long-running” events. Events like product recalls and Service dispatches typically last far longer than a single decision. Optimization involves the continued gathering of constraints and objectives parameters, applying optimization techniques, and arriving at the best possible solution. Note that it is highly likely that for long running events optimization must be continuous to continually work to improve the overall result and deal with unforeseen changes in plan.

Dynamic Event Management is a preferred term to describe a fast growing field called Business Process Management (BPM). Dynamic Event Management describes the “orchestration” of one or more resources to accomplish a given objective. These resources can freely exist inside or outside a given company and in our outsourced world will frequently be a mix of the two. The dynamic descriptor is appropriate as the managed workflow can respond to events and make in-process decisions, provided it does not impact the optimization boundaries already established. In the event that boundaries are exceeded, the workflow can be put in hold state, a re-optimization can occur, then the same or altered workflow can re-start.

While the BPM market is rapidly growing, it is not apparent than any existing tools have the dynamic controls and tight integration with a large-scale optimization capability. It is however expected that well within the ES&S readiness timeline such tools will have been successfully deployed.

F. Applications

A number of examples will be presented to explore the power of the “Smart Operations” concept. The OEM Product Recall example represents a typical complex, long running business problem with many dimensions and competing priorities. The Optimized Service Delivery example demonstrates the power of connecting the product-based predictive tools under development today to the back-end execution capability. Finally a straightforward extension of the architecture is explored as to its applicability to the hierarchical challenges of managing a future military battlefield.

F.1 Optimized Product Recall – OEM

F.1.1 Background

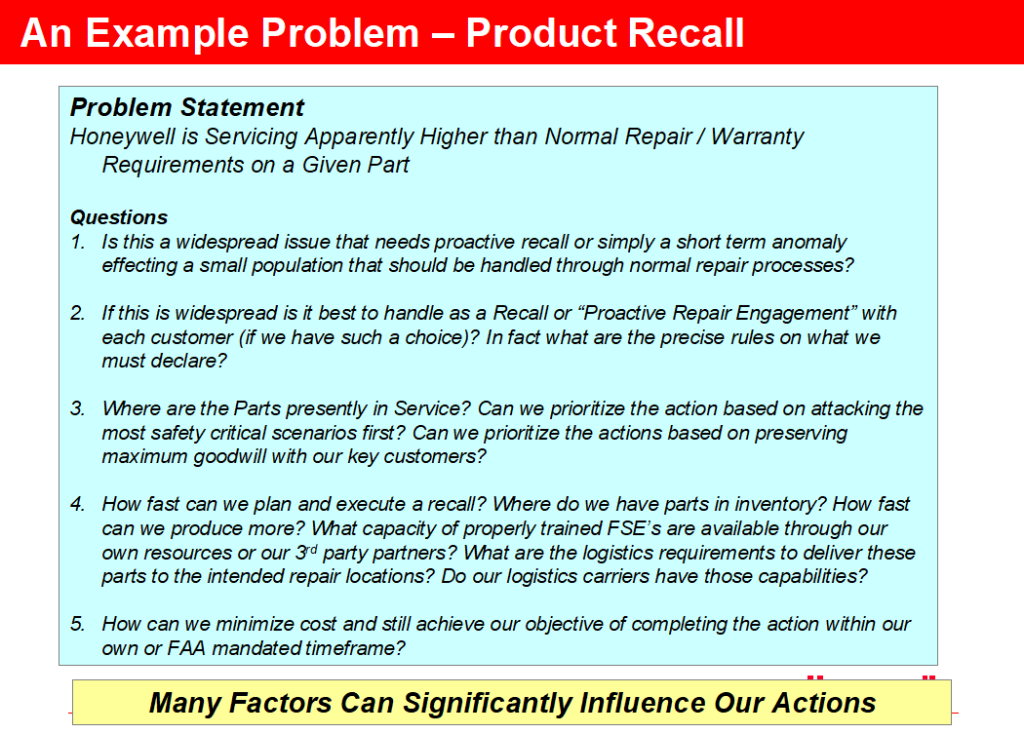

One common challenge facing any complex product producer is the possibility of having to issue a product recall to fix a latent defect in design or manufacturing. In the Aerospace industry this problem is especially critical for two primary reasons: (1) defective products can jeopardize the safety of passengers; (2) taking a very expensive asset (airplane) out of service for even a short period of time can be economically devastating to a Customer.

With that backdrop we already begin to see important optimization criteria for a “Smart Operation.” First, we are incented to complete the overall recall in a minimal total cycle time. That would be a proxy for reducing the number of flights and thus passengers exposed to a potentially unsafe aircraft. Second, we should strive to minimize repair cycle time so the valuable asset is out of service for as short a time as possible.

F.1.2 Problem Statement

Figure F.1.2 depicts common questions asked by business analysts as they review product reliability information. What is so often hard to discern is whether the reliability is exhibiting some short-term negative phenomena, still within control limits, or whether a recent spike is indicative of a more significant problem. Analysts then begin to ask an additional set of questions to attempt to better understand and potentially solve the problem.

F.1.3 Bounding the Problem

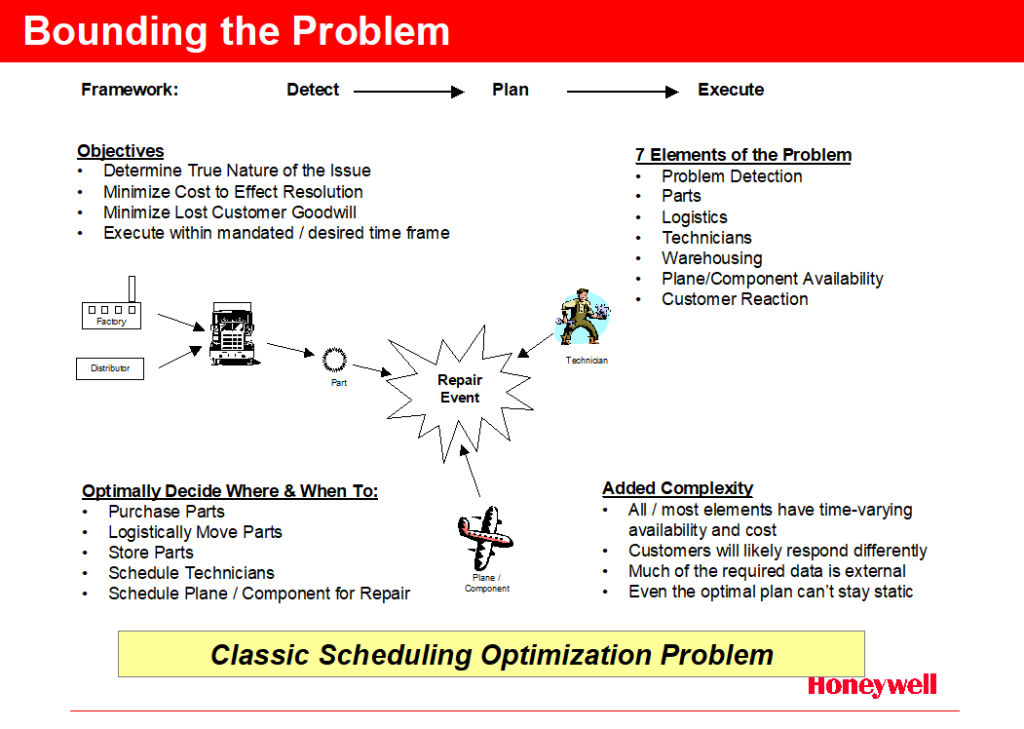

Once a recall decision is made it is helpful to bound the problem and understand what variables can be manipulated to best complete the task. Figure F.1.3 represents a cataloging of independent and dependent variables that would play a primary role in a recall event. The objectives as stated above are to complete the recall as quickly and cheaply as possible abiding by all compliance requirements and minimizing Customer dissatisfaction.

Of note, several of the key variables are both time varying in cost and availability. As the magnitude of the recall could span tens of Customers, and thousands of parts the complexity can easily become overwhelming.

F.1.4 Problem Formulation

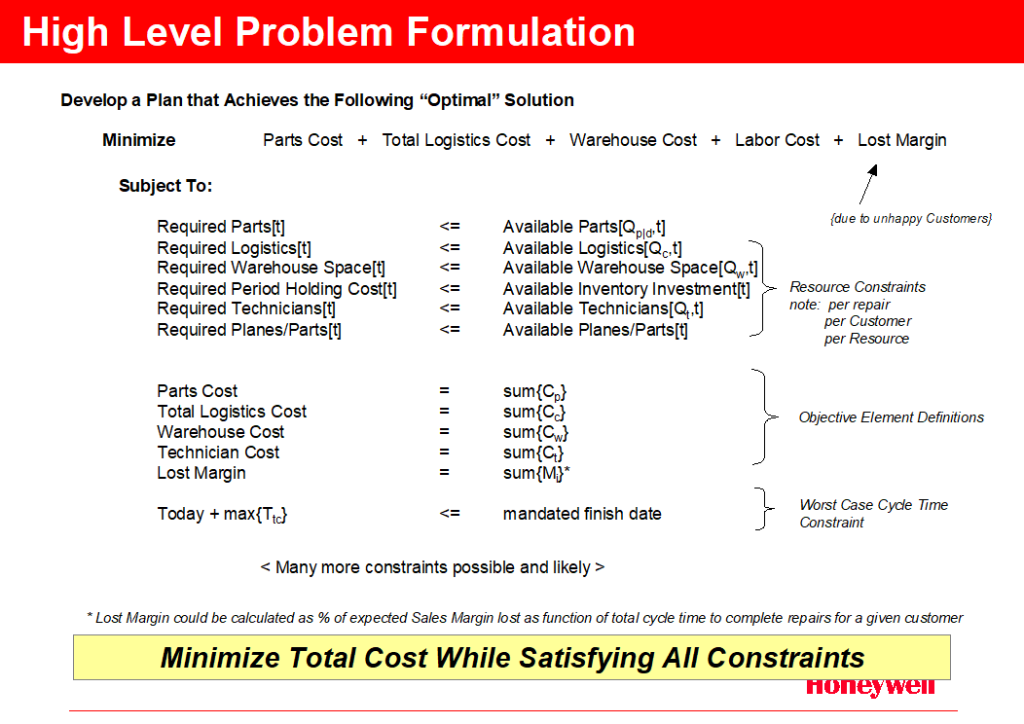

As the recall problem is explored it becomes apparent that it directly parallels a classic scheduling optimization problem. Within that framework we can formulate a problem description as in Figure F.1.4. In that formulation we wish to minimize cost (note the lost margin due to Customer dissatisfaction with total cycle time) while subject to any number of constraints – in particular part, technician, logistics, and Customer plane availability.

F.1.5 Constraint Data

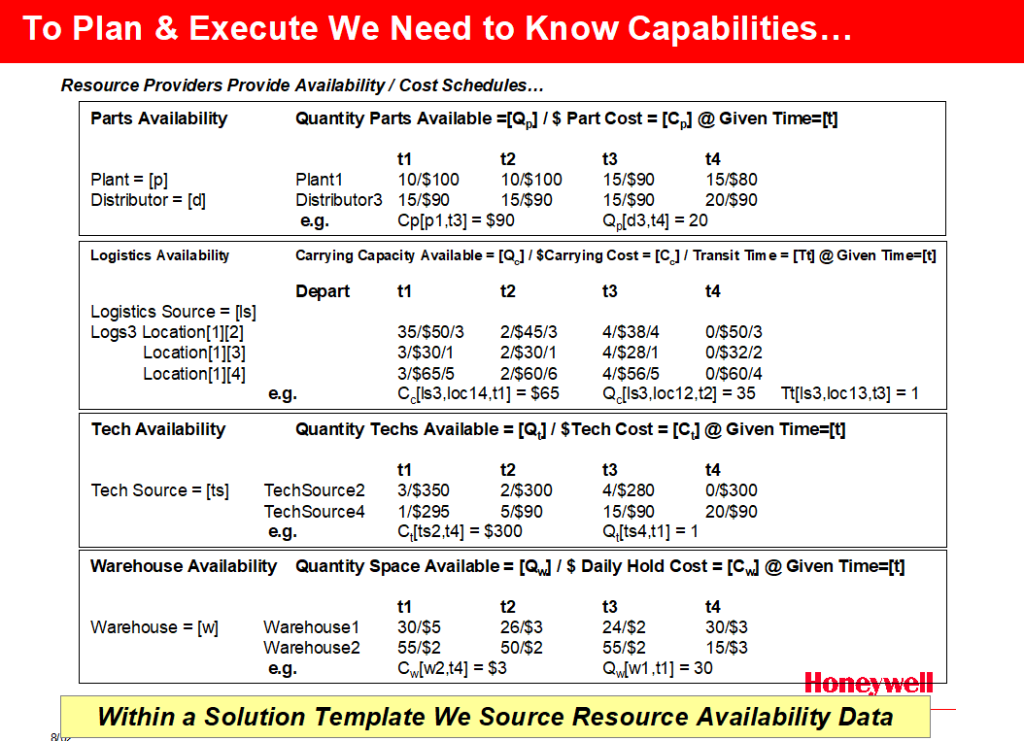

To proceed with problem solution it is necessary to collect available data on the constraints in the formulation. This entails interacting with both internal and external systems to directly pull availability data according to a scripted set of information needed. Here the B2B integration capability provides rapid, low-cost information from suppliers systems that can be directly fed to the optimizer. Note that this same mechanism will be used to collect ongoing performance signals that allow the business process manager (or BPM tool) to track progress and if necessary re-start the optimization cycle.

Once the capability data has been gathered a matrix can be constructed similar to Figure F.1.5. This tabular listing of constraint availability ultimately decides what optimization can be achieved.

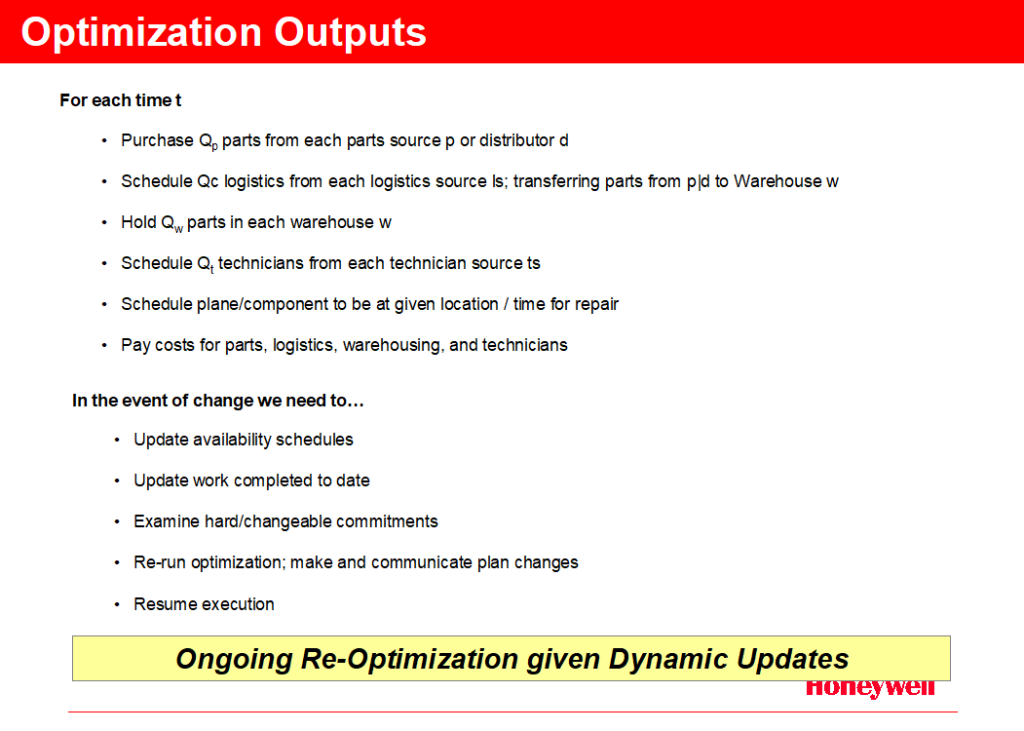

F.1.6 Optimization Results and Activation

As the optimization completes we are told the specifics of how to execute the recall to meet the objective. Figure F.1.6 depicts the results of the process and the scripted workflow can now continue by initiating specific transactions (internally and externally) to launch the process. As noted, performance signals are collected from all Suppliers and internal systems to provide a dynamic control capability. As necessary a re-optimization is launched to handle exceptions or seek continued optimization.

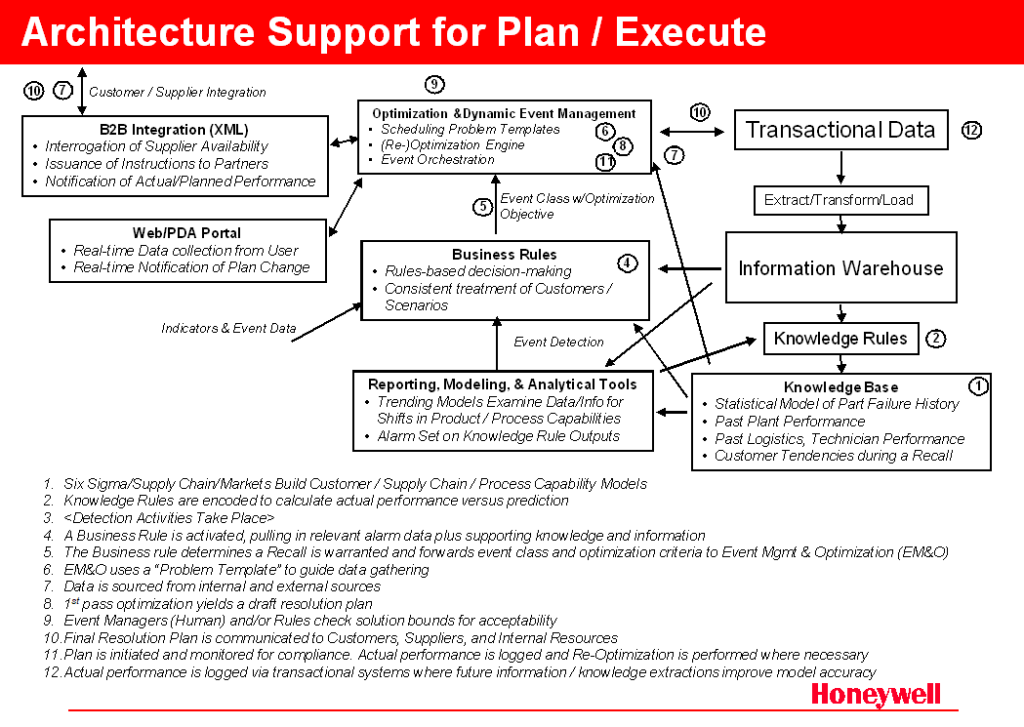

F.1.7 IT Architecture Support for Product Recall Optimization

Figure F.1.7 provides a keyed” walk-through of how each architectural component of the Architecture participates in the execution of the recall challenge.

F.2 Optimized Service Delivery – Aftermarket Services

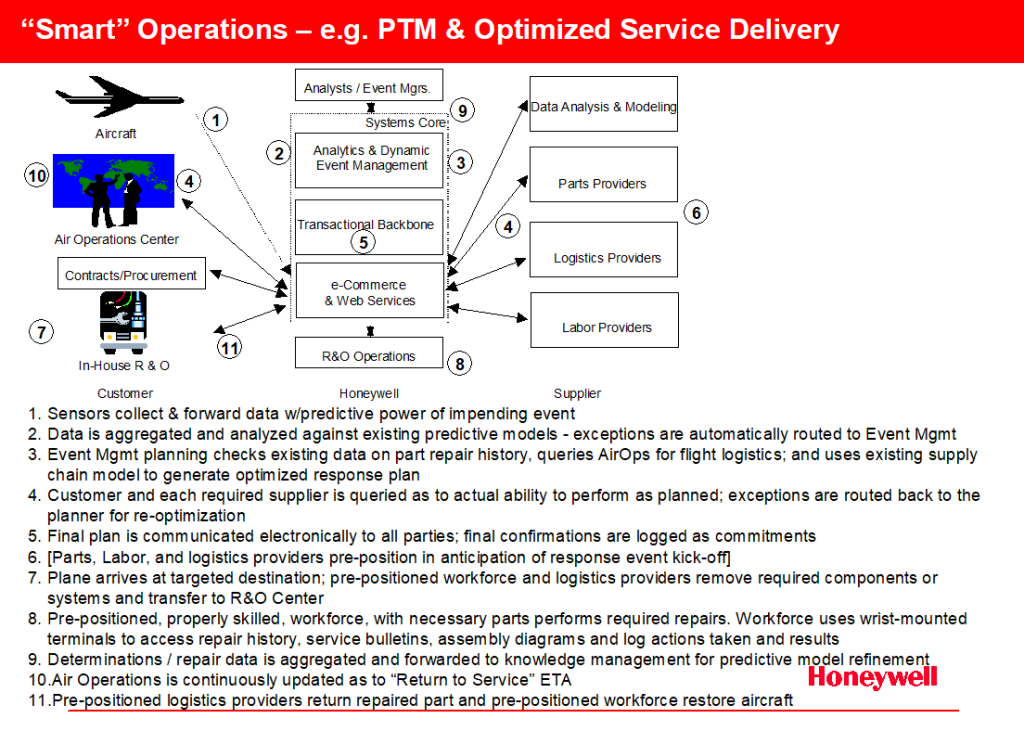

Without all of the supporting detail, the Optimized Service Delivery opportunity can be served in a completely analogous way. ES&S’s emerging predictive tools for various products will provide highly valuable lead-time from which we can extract significant value – PROVIDED we have the ability to activate the appropriate response.

Figure F.2 depicts a similar flow diagram, this time at a higher level, but still highly analogous. This figure also has the advantage of showing some of the key systems integration requirements between Honeywell and its Customers and Suppliers.

F.3 Mission Management on the Battlefield of the Future

Finally we look to apply the same principles to the Mission Management requirements on the battlefield of the future.

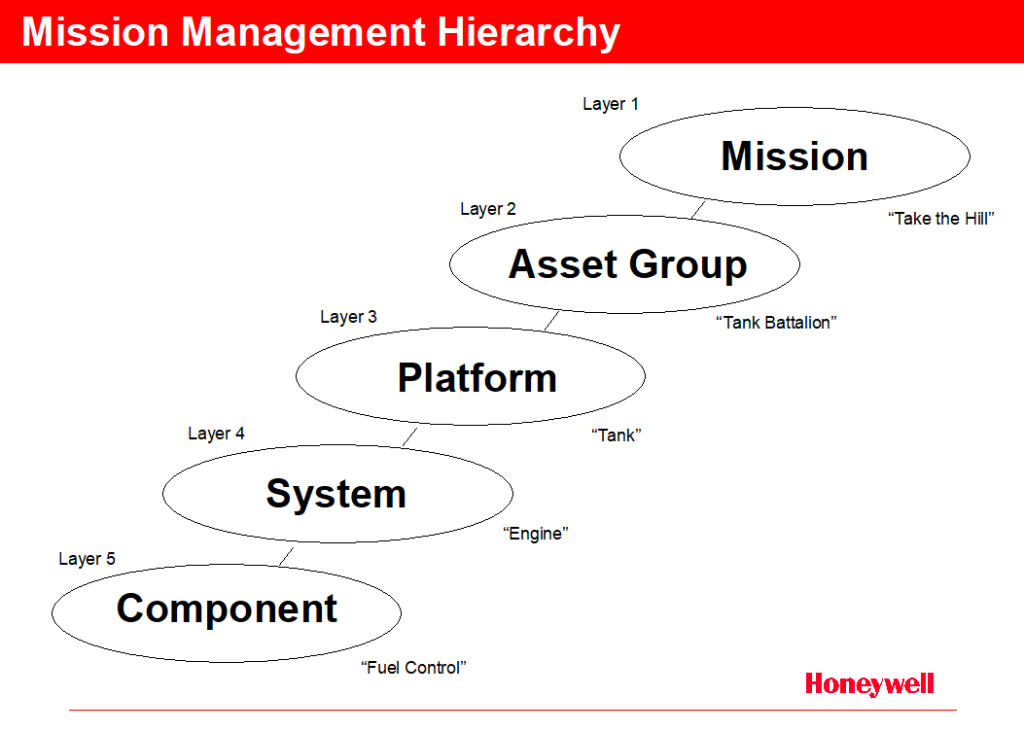

In this scenario, mission managers must orchestrate a collection of asset groups (tank battalions, fighter wings, etc) into an effective fighting force. To do so requires accurate performance models as well as logistics requirements and capability models, opposing force behavior models, and a myriad of other modeled factors (effects of weather, terrain, etc on effectiveness). It is hypothesized that this problem is fundamentally no different than the economic and business process challenges described above.

A simple decomposition of the mission management scenario is provided in Figure F.3a. This shows the hierarchical nature of the problem as each discrete asset has a vitally important role in the overall mission execution. The Mission – Asset Group – etc descriptions are simply illustrative of the problem and not specific recognized terminology.

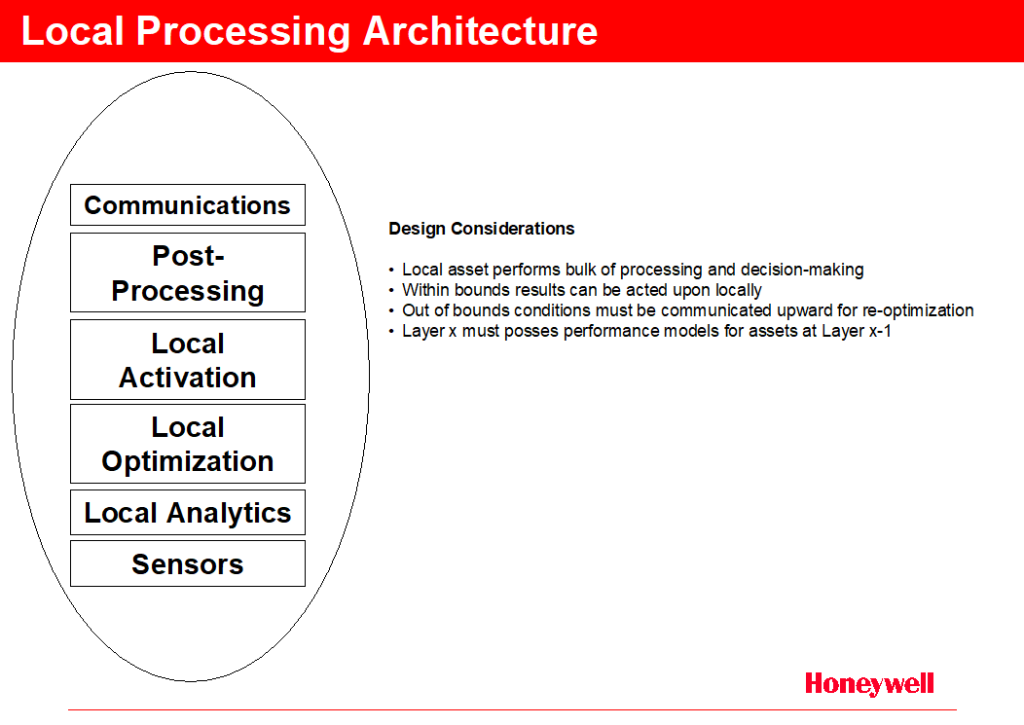

As we investigate the processing architecture, it is offered that local processing (one instance of the offered IT architecture) will be advantageous. Figure F.3b describes a local processing architecture with some additional design considerations.

Also, the Honeywell HTSL efforts around SHARP (Real-Time Operating System) could be an excellent platform for such distributed processing requirements. A Linux-based kernel would be standards-based, “lightweight,” highly open and configurable. A robust real-time kernel with specialty “Smart” software modules for specific processing responsibilities (see the processing architecture below) could be easily built on a per component or system basis. This would further optimize the processing requirements on the given platform.

In terms of the described IT architecture, one could argue that simply applying the functionality of the components but in a recursive way allows for optimized management of a now hierarchical asset management problem. Clearly additional factors must be considered. First, the vast majority of communications between assets will be wireless. Given lower data rates than hardwired links, it would be critical to optimize the amount of required data transfer between assets. Second, response time must be significantly faster in a scenario where literally seconds count. This furthers the argument for data reduction, local processing, and other time saving design features.

G. IT Technologies & Services

While there is a significant amount of new (to ES&S) technology described in the Architecture section, it is worth noting that many of these technologies have been successfully deployed in the marketplace. With that said, this section is intended to generate thought about the specific objectives for our “Smart” activity and how Suppliers and Partners can work with us to rapidly and effectively build out the architecture.

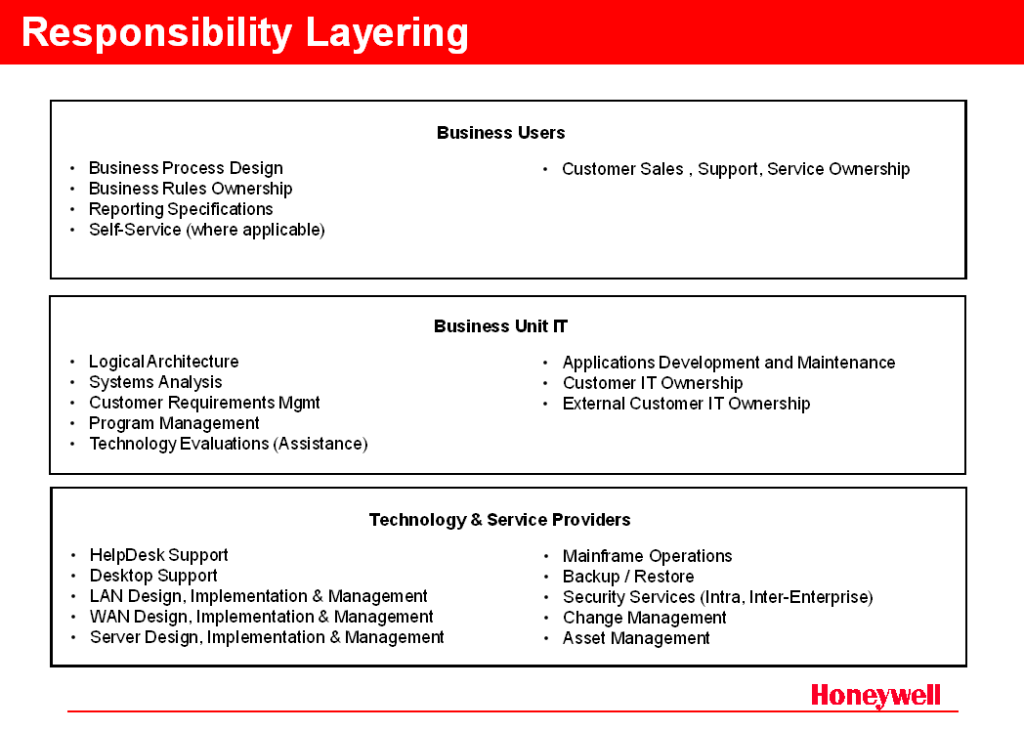

Another useful construct is the layering of responsibilities between the Business, Business Unit IT, and the Technology & Services providers (e.g. ITG, Oracle, SAP).

G.1 Responsibility Layering

At a high level Figure G.1 depicts the layering principles. It would simply be unrealistic to expect that the Business Unit IT team could comprehend, design, construct the entire solution from highest to lowest value. Layering, with appropriate standards-based interface between could radically speed up implementations while offering the greatest opportunity for aggregating demand and generating volume-based advantages.

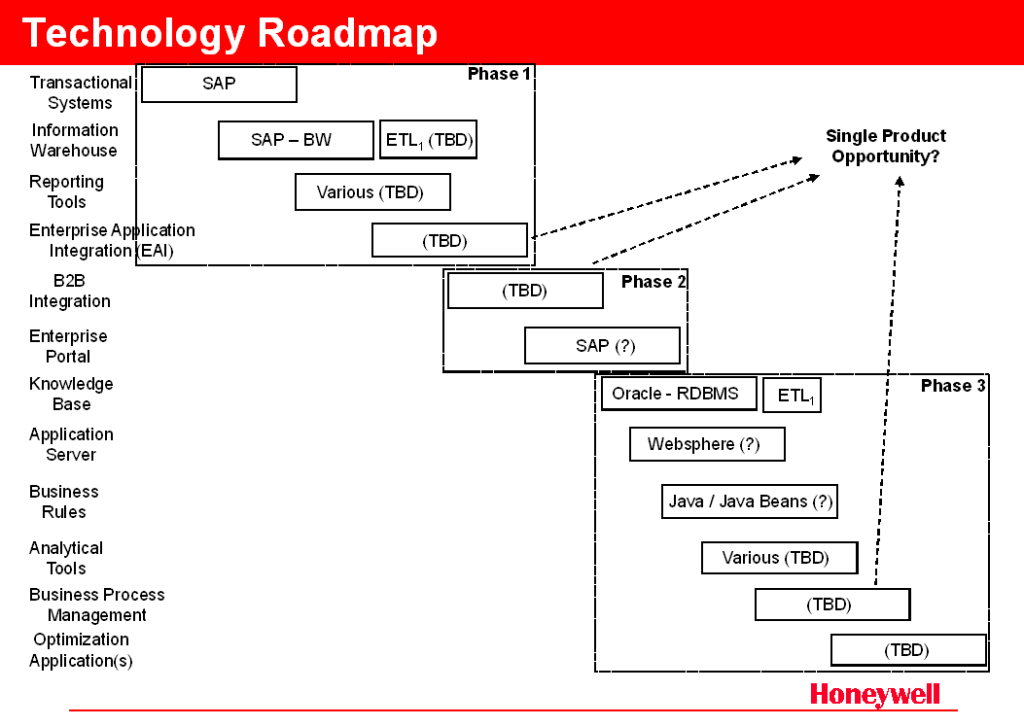

G.2 Technology Roadmap

Figure G.2 describes a notional Technology Roadmap that defines the core technologies required to build out the entire architecture. It is worth noting that the majority of these technologies are readily available which provides significant confidence in our ability to successfully deploy them. Although some phase 3 tools are immature they are full expected to be robust within our required timeline.

Of note is an opportunity to evaluate single products to play multiple roles. Most notably, the convergence of EAI, B2B Integration, and Business Process Management tools presents a tremendous opportunity to reduce integration and support complexity by leveraging one tool. Existing Corporate evaluations of these tools should provide a wealth of information in this space.

Also worthy of mention is the desire to have the Business Rules hosted in a separate tier of the architecture, likely on a highly scalable and robust application server. The availability of these Business Rules to any other element of the architecture will greatly enable reuse and consistency, particularly in meeting analytical requirements.

Other unspecified choices are perhaps made easier by the introduction of SAP into the Aerospace environment. Serious consideration of the SAP Enterprise Portal and mySAP.com components makes sense as the time and cost to integrate new functionality into the environment are significant drivers. The decision to include mySAP.com elements will likely be influenced over the amount of accessibility and control over their core optimization functionality.

G.3 Services

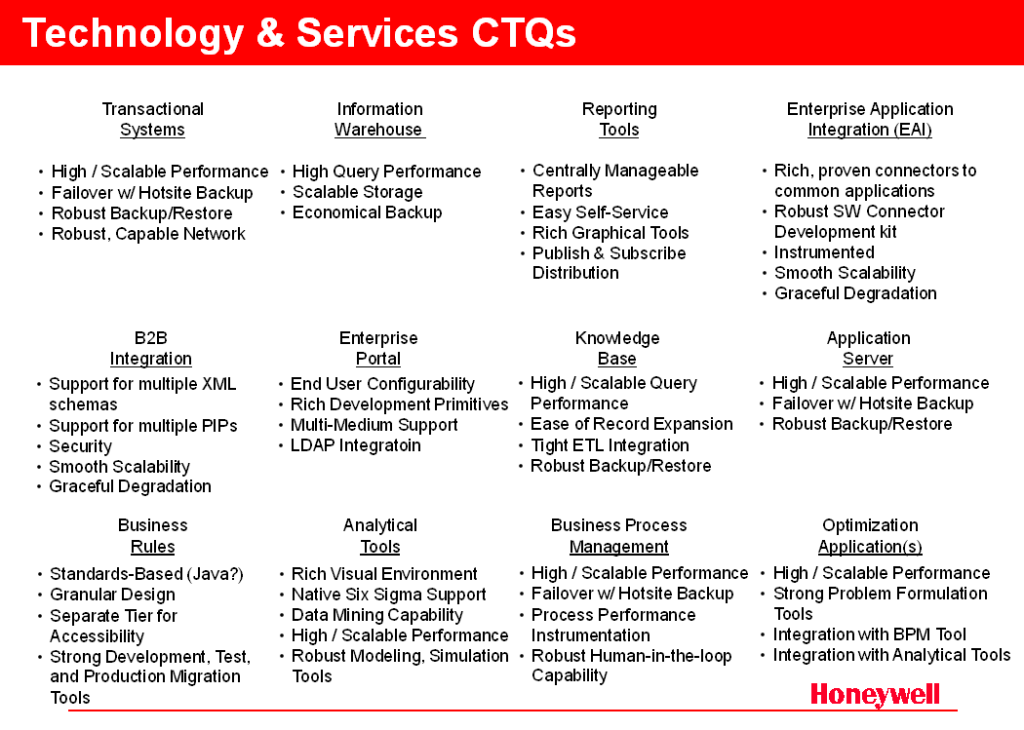

To power this (or any) advanced IT architecture it is imperative to have a robust, underlying set of IT “services” and systems. This foundation is key to speeding the deployment of the key functionalities needed for “Smart Operations”. Figure G.3 outlines some of the key Critical to Qualities (CTQs) for the various architectural elements.

H. IT Enablers

There are several key enablers required of an IT organization to successfully deliver on the promise of “Smart Operations.” Each of these key enablers is briefly described to provide a flavor of the supporting actions that must be taken in conjunction with the new technologies, processes, and roles of IT within the business.

H.1 Organization Design

As the “Smart Operations” concept evolves architecturally it is important that the IT organization respond to ensure successful development and deployment. Generally, “Smart Operations” relies heavily on a centralized aggregation of information to ensure high quality creation and management of knowledge. To that end there are three key elements of that future organization.

First, a centralized data management organization that drives the Enterprise data, information, and knowledge model will greatly facilitate consistency and confidence in the decision-making inputs. No knowledge can realistically be generated without consistency at the transactional level, and without strong standards it will be difficult to leverage resulting knowledge.

Second, it is also key to centrally define the Business Rules, with particular focus on development technology and standards. This will allow rapid and confident re-use, which will promote consistent bases for decisions. Although development itself will be done on a world-wide basis, strong enforcement of standards, quality assurance, and robust test and production controls will be key. This will require an organization (not large) to define and maintain strict development standards.

Finally, it is important to develop a robust analytical team that brings strong expertise in modeling, simulation and similar tools that can provide a leveraged body of knowledge to the various business teams.

H.2 IT Skills

As noted in the IT Strategy slide (Figure D.1) there is a clear requirement for skills transformation in the IT organization. While the primary Phase 1 activities rely on common IT skills (large program management, systems consolidation, etc.), successive phases will require active skills development.

Within Phase 2, organizations will need to expand their reach into multiple e-Business technologies including XML, Web Services, and Web Portals. Additionally IT will need to gain familiarity in working inter-company projects to accomplish the required integration. Further, IT will find it helpful to become more involved with various industry and technology standards groups. Active participation in these groups can help shape their agenda and ensure that business objectives are more easily reached.

As the organization begins to support Phase 3, there will be tremendous demand on the IT organization to play an expanded role with the business partner. In particular, IT staff will need significant business process and overall higher levels of business acumen. These skills will be most acute in the development and use of the Business Rules, Knowledge Management, and Business Process Management capabilities. The objective is to promote a tighter integration of IT and the relevant business functions to ensure maximum value in the shortest time possible. In part the staffing vision is to have considerable import / export of talent from the IT analytical roles to / from the Business Process Analyst roles.

J. First Steps

There are three key first steps that are recommended for the IT and Business teams to begin laying a foundation for long term success. These are primarily focused on long-lead items to ensure readiness as resources become available to begin serious work.

First, various SBU, SBG, and Corporate IT resources should become engaged in a holistic discussion of architectural issues. Finding points of commonality in requirements and architectural directions may greatly focus available resources on particular elements of the architecture and drive proper prioritization and common standards to promote reusability.

Second, IT must engage the business in a meaningful discussion of “Smart Operations.” That discussion will gauge realistic interest and ability to participate in the definition, design, and establishment of realistic timelines. While it is firmly believed that this architecture is strategically sound, timing of investments need to coincide as accurately as possible with expected business payback.

Third, IT must carefully define the relative career paths and skills required over time to populate the future staffing model. Given that many of the required capabilities are not commonly held by today’s IT staff, it is desirable to draw out specific actions to immediately begin development of Phase 2 and soon Phase 3 skills.

K. Appendix

K.1 Reader’s Guide

A suggested reading agenda is made to help various readers optimize their time and get the salient points. It is if course encouraged that everyone read all sections for the entire “story” but realistically different parts of the paper are targeted at different reader groups.

Business / Process Leader:

Strongly recommended: A, B, C, F, J

Recommended: D,

Optional: E, G, H, I

IT / Technologists

Strongly recommended: A, C, D, E, G, H, I, J

Recommended: F

Optional: B